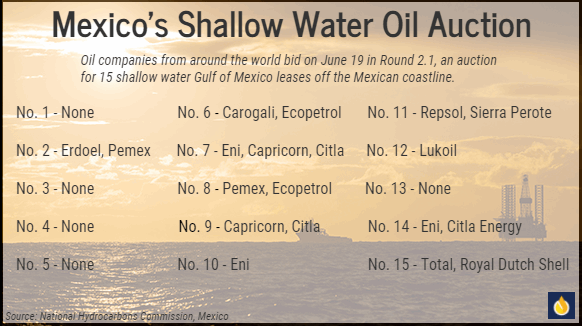

Mexico’s Gulf of Mexico shallow water auction June 19 awarded 10 of 15 blocks to the likes of Eni, Royal Dutch Shell and Total – suggesting the nation’s bet on foreign oil company investment will pay off.

Round 2.1 in the nation’s auctioning process for private companies to lease southern blocks drew participation from 20 companies from more than a dozen countries. Pablo Medina, Wood Mackenzie’s senior analyst for upstream Latin America, live-Tweeted on the proceedings, which were broadcast live from Mexico’s National Hydrocarbons Commission headquarters in Mexico City.

Awarding two-thirds of the blocks to international companies is “an amazing result for Mexico,” Medina Tweeted.

Almost 20 percent of the United States’ total crude oil production comes from the Gulf of Mexico – a basin of opportunity for the nation for decades – and now, oil and gas companies from around the world are tapping into Mexico’s southern share of the briny waters.

In January, the U.S. Gulf produced about 1.7 million barrels of oil per day (bpd), according to the U.S. Energy Information Administration. That’s more than enough to easily power the consumption needs of France, Indonesia or the United Kingdom.

And surely, industry insiders believe, the opportunity for offshore Mexico must be there, too.

“Geology doesn’t know geographical boundaries so if there’s oil on the northern side, I’m pretty sure there’s going to be oil on the southern side,” said Scott Munro, vice president of Americas, Europe and Africa at McDermott International. “But then, that’s just a guess – it’s definitely a forward-looking statement.”

It’s a guess that many companies are banking on.

Mexico’s Gulf of Mexico acreage is vastly underexplored and certainly unexploited compared to the waters of the United States – and with the emergence of Mexico’s newly open market, the nation is virtually awash in offshore opportunity.

Three offshore bidding rounds since 2015 have yielded interest from supermajors to private companies trying to make it as first-movers. Already, Exxon Mobil Corp., Total, Chevron, Statoil and BP have shallow water concessions in the Sureste Basin, and a second deepwater lease auction is scheduled this year.

Courting Currency

To be sure, Mexican government leaders are anxious to catch up. On May 21, a well was spudded in Mexico’s Gulf without the input of long-time monopoly Petróleos Mexicanos (Pemex). The joint venture of London’s Premier Oil, Houston’s Talos and Mexico’s Sierra Oil & Gas spudded the first private well, a shallow water investment called Zama-1, in 80 years. Zama-1’s scorecard is expected in July, when its results will be released. The well is estimated to access between 100 million and 500 million barrels of oil and has a 52 percent geological chance of success, said analysts at Edison Investment Research.

Driving Mexico’s 2014 reform was the impact of oil production declines, coupled with plummeting oil prices, on its treasury. State-owned Pemex has been the sole producer since 1938, but the company’s ability to invest in new production has dried up. In 2004, the Cantarell shallow water play produced more than 2.1 million bpd, but by 2015, production was down to less than 280,000 barrels of oil equivalent per day (boepd), Edison noted.

But reform efforts to lure investment appear to be working. Service providers, such as McDermott, are already on the ground. McDermott made its presence in Mexico four years ago, and the company plans to double its headcount there by the end of the year.

“There’s a little bit of an advantage on the Mexican side of the border over the U.S.A. It can be lower risk, lower cost for our customers because there’s a lot of shallowater opportunities that are still left,” he said. “In the U.S., most of the good shallow water pickings have been taken, so everyone is playing in the deepwater. And of course, that requires a lot more capital to play.”

Companies including Italy’s Eni E.p.A, Argentina’s Pan American Energy, and Talos Energy LLC in the U.S. are already drilling the leases they acquired in Mexico’s shallows.

Getting Deep

The shallow water plays have a significant advantage on deepwater, Munro said, because of the infrastructure in place to attract drillers. The area is so well-established that Pemex is producing two million barrels per day from three operations there, he said.

But extracting hydrocarbons from the deep will take longer.

“In deepwater, there’s no existing production,” Munro said. “It’s true greenfield territory.”

To be sure, there is some concern that Mexican regulators’ lack of experience in deepwater drilling could pose safety challenges. A fire broke out at Mexico’s largest oil refinery following a tropical storm on June 14, and the nation’s safety protocols lag U.S. regulations.

“All these companies are going into Mexican deep waters naked with none of the protections set up on the U.S. side,” George Baker, publisher of Mexico Energy Intelligence, told Reuters.

Others say there is time to address important safety protocols. Production in Mexico’s deepwater Gulf is likely years away, and deepwater operators in the U.S. Gulf – those most likely to engage in Mexico’s Gulf – have experience with the geology there.

Indeed, less than 45 exploration wells have been drilled in Mexico’s deepwater – a small fraction of the more than 1,200 such wells in the U.S. deep Gulf. The first and only deepwater bid so far was Mexico’s most successful, noted analysts at Edison Investment Research in a June note. Eight of the 10 leases up for auction were scooped by the likes of Exxon, Chevron, BP and Statoil – companies that intend “to bring their U.S. experience to acreage that offers plenty of running room,” Edison said.

Statoil first entered Mexico in 2001, and the Norway-based company is eager to capitalize on new opportunity there, said Helge Hove Haldorsen, Statoil Mexico’s general director, in an interview with Offshore Engineer in May.

“Mexico has yet to find significant potential offshore, particularly in the more frontier deepwater areas,” he said. “Most of the Mexican deepwater is either underexplored or not explored at all, which of course from an exploration perspective is very exciting.”

source: http://www.rigzone.com/news/oil_gas/a/150657/Mexico_Whets_Foreign_Oil_Gas_Appetite_Awards_10_Shallow_Water_GOM_Blocks/?pgNum=1